It doesn’t take a college degree to appreciate the looming student debt crisis. Student loans are now the second largest source of individual indebtedness in the US, between mortgage and credit card debt.

The table below demonstrates the current state of individual debt in the US as of early 2014. The amounts, taken from multiple sources, rely on data published by the Board of Governors of the Federal Reserve. (http://www.federalreserve.gov/). Not all the numbers are available on the Federal Reserve reports and some extrapolations using data series from sources, like credit card, student or housing organizations, were needed to complete this overview. Nonetheless, this information provides a good overall idea of how big the debt burden is and how many individuals are affected. Hopefully this will help us better understand the true impact each type of debt has on the indebted individual potential for economic success.

| Debt Type | Total Amount owed | Affected Population | Avg amount owed |

| Mortgage | $9.37 trillion | 61 million | $152,000 |

| Student Loans | $1.08 trillion | 37 million | $29,400 |

| Credit Card | $856 billion | 69 million | $15,200 |

Housing and mortgage debt

We don’t have much to add to the torrent of articles written about the housing market in the wake of the financial crisis and the large scale mortgage defaults. We are only interested in the data because it gives as an opportunity to examine the affordability of this debt burden. Naturally when examining averages there is much that is lost at the extremes, individual stories of defaults and unaffordable mortgages. But averages can tell a story and the $152,000 avg. mortgage at an avg. 4.75% interest rate over 30 years translates to payment of $792 per month.

With median household income of $52K (avg is much higher standing at approximately $69K), mortgage debt accounts for about 18% of household income and ON AVERAGE is an affordable burden.

Student loans

The first thing to point out about student loans debt is the 37 million ex-students with the avg burden of $29,400 refer to individuals than households. This is an important observation considering the basic sociological postulate of marrying within your social group. People with a college degree are likely to marry people with a similar level of education which is likely to increase the household burden to $58,800 or more.

About 20 million Americans attend college every year, and 60% of them borrow to cover cost of college. Of the 37 million indebted students 23 million are over the age of 30, many well into their 50’s and 60’s and still paying out their student loans. (for a full breakdown of who borrows and other interesting stats: http://www.asa.org/policy/resources/stats/)

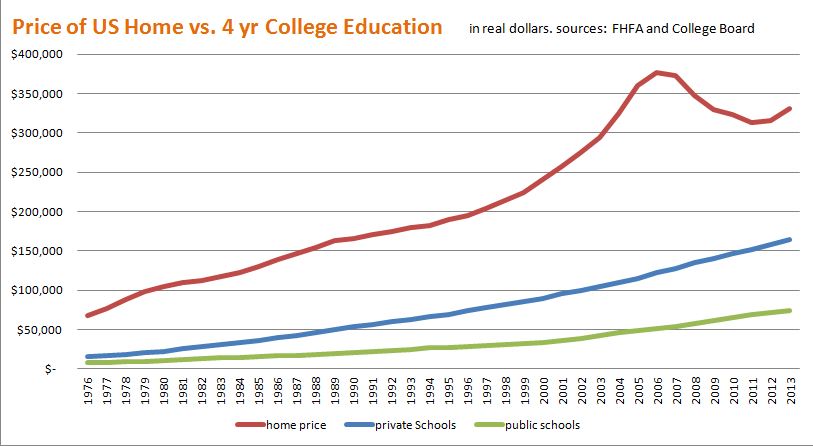

According to CNN money the class of 2013 owes an average of $35,200. And with tuition and fees rising at rate of 5% per year this number will only go up.