Thanks to shows like Extreme Couponing, Americans are always looking for bargains. One industry where that obsession with the cheapest price is most obvious is in clothing… and women’s fashion. Not that long ago, a television news photographer photographed First Lady Michelle Obama as she shopped for clothing at a Washington D.C. Target store.

The popularity of outlet stores, discount stores and value retailers are proof of this wish to buy things for the cheapest price. Wal-Mart, Target, Old Navy, H&M, Forever 21, TJ Max, DSW, are just a few examples of retailers catering to our un-satiated appetite for low priced fashion. Even luxury retailers like Saks Fifth Avenue have joined the outlet craze with their Saks OFF Fifth stores. Putting aside the question of quality, modern shoppers, not only Americans, but in most developing countries, simply cannot resist the urge to consume clothing and accessories at alarming quantities.

The popularity of outlet stores, discount stores and value retailers are proof of this wish to buy things for the cheapest price. Wal-Mart, Target, Old Navy, H&M, Forever 21, TJ Max, DSW, are just a few examples of retailers catering to our un-satiated appetite for low priced fashion. Even luxury retailers like Saks Fifth Avenue have joined the outlet craze with their Saks OFF Fifth stores. Putting aside the question of quality, modern shoppers, not only Americans, but in most developing countries, simply cannot resist the urge to consume clothing and accessories at alarming quantities.

Is It Really a Bargain?

Women always feel pressure to look good, to wear clothing that’s in style, and to be the first among their friends to fill their closet with the most popular and cheapest fashion. Women are in competition with each other to see who can get the most clothes, fill their closet faster, and pay less for their haul. Cheap clothing is encouraging an obsessive behavior, especially with women, many of whom self describe as shopaholics.

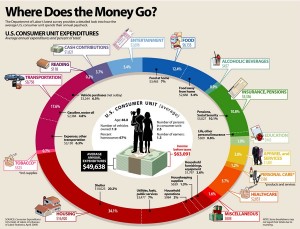

The numbers very much support the obsession. According to the latest Department of Labor Survey, the average Consumer Unit (that’s 2.5 people) spend almost 4% of their $49.5K annual expenditure on Apparel and Services, that’s almost $1700 and double the amount we spent on clothing 20 years ago. Considering our obsession and the fact that much of this money is spent impulsively on items no one really needs, it makes you wonder about the real price of cheap fashion.

The numbers very much support the obsession. According to the latest Department of Labor Survey, the average Consumer Unit (that’s 2.5 people) spend almost 4% of their $49.5K annual expenditure on Apparel and Services, that’s almost $1700 and double the amount we spent on clothing 20 years ago. Considering our obsession and the fact that much of this money is spent impulsively on items no one really needs, it makes you wonder about the real price of cheap fashion.

What about the Social Price?

Most of the cheap clothing Americans are buying wasn’t made in the United States. China and Bangladesh are two of the main sources of import, roughly 40,000 factories in China, and 5,000 factories in Bangladesh, employing about 4 million workers. Bangladesh, where the poverty rate is among the highest in the world, pays the the average garment industry worker about $37 per month. Chinese workers make about $200 per month. The $20 billion a year industry is no doubt a major economic force in Bangladesh, but as important it is, it is far from being rewarding for its workers.

In April of 2013, a tragic building collapse on the outskirts of Dhaka in Bangladesh killed no less than 1100 people, almost all of whom were garment workers. Recovery workers pulled another 2400+ people who survived the nine-story building collapse, from rubble. There were also reports that only 18 building inspectors were responsible for overseeing the safety of 100,000 garment factories. Disregard to basic safety standards, extremely low minimum wage standard, finally brought about change when workers took to the streets demanding the closure of 400 factories. The result, a 77% increase in minimum wage to $68 per month. Think how bad it was it for Bangladeshi that such a “steep” increase was so quickly adopted.

Will this affect the price we pay for our obsession? It’s too early to assess… Was it only the price global retailer and brands paid for the garments manufactured in these factories? Or was it the greed of factory owners? Only time will tell us how this impact what we pay at the register. But the more important question we should ask is, why is this industry exempt from the critical review of its supply chain? Why do we like to scrutinize Apple’s oversight of its manufacturing operations in China, but criticize H&M only after the catastrophe that cost 1100 people their lives?

No one can help the Bangladeshi workers better than the Bangladeshi worker. Taking to the streets, demanding better pay, and safer healthier work environment is much more effective than the faint outcry sounded by the west following the Dhaka disaster. But surly we can sleep better in our $9.99 Target’s pajamas and walk prouder in our $19 Old Navy cropped pants if we did our part and demanded that Corporate’s Global Responsibility activism did not come after the fact.